Exploring the Relationship Between Business and Economics in today's Digital Era

Exploring the Relationship Between Business and Economics in today's Digital Era

Blog Article

Understanding Financial Principles for Better Business Decision-Making

In the facility landscape of contemporary service, a thorough understanding of financial principles can substantially boost decision-making procedures. By examining elements such as market frameworks and consumer actions, companies can customize their methods to straighten with competitive dynamics and consumer requirements. Additionally, understandings into demand flexibility and opportunity prices offer a framework for maximizing source appropriation. The application of these financial theories typically exposes unanticipated obstacles and opportunities that can redefine tactical approaches. What implications do these understandings hold for the future of company technique?

The Essentials of Economic Theory

Economic theory works as the foundation for understanding just how organizations and people choose in the visibility of deficiency. At its core, economic concept takes a look at the allowance of limited sources to satisfy limitless desires. This essential concept of shortage demands trade-offs, engaging decision-makers to examine the advantages and expenses linked with numerous options.

Both primary branches of economic theory are microeconomics and macroeconomics. Microeconomics focuses on private agents, such as customers and firms, examining their behavior and interactions in particular markets. It stresses ideas like supply and need, price flexibility, and market stability, which are vital for understanding just how rates are established and just how sources are dispersed.

Conversely, macroeconomics checks out the economy in its entirety, addressing wider issues such as rising cost of living, joblessness, and economic development. It supplies understandings right into systemic phenomena that affect all financial representatives, directing policymakers in crafting effective economic techniques.

Ultimately, a solid grounding in economic concept is vital for efficient organization decision-making. By recognizing the concepts of deficiency, compromises, and market dynamics, companies can better make and navigate complicated environments notified choices that boost their competitive benefit.

Key Economic Indicators

Key financial signs serve as essential devices for analyzing the wellness and instructions of an economic climate, supplying valuable insights for company decision-making. These indications are quantitative actions that mirror the financial efficiency and can be categorized right into leading, delaying, and coincident signs.

Leading signs, such as customer confidence indexes and stock market patterns, predict future financial activity, permitting organizations to anticipate modifications on the market. Delaying signs, like unemployment prices and business profits, provide insights right into the economic situation's past performance, assisting businesses to review long-lasting fads. Coincident indications, such as GDP growth and retail sales, fluctuate at the same time with the economic climate, using a real-time photo of economic problems.

Recognizing these signs enables services to make educated choices pertaining to investments, source allocation, and critical planning. A surge in consumer self-confidence may motivate companies to raise production in anticipation of greater demand. On the other hand, climbing joblessness prices may lead to a reevaluation of expansion plans. By carefully monitoring these essential economic signs, organizations can navigate unpredictabilities and place themselves efficiently in the ever-changing economic landscape, ultimately boosting their decision-making processes and long-lasting success.

Market Structures and Characteristics

Comprehending market frameworks and characteristics is critical for organizations intending to flourish in competitive environments. Market frameworks, extensively classified right into ideal competitors, monopolistic competitors, oligopoly, and syndicate, significantly influence pricing methods, product differentiation, and affordable habits. Each framework provides unique obstacles and possibilities that can determine a company's tactical direction.

Oligopolies, characterized by a couple of dominant players, lead to synergistic decision-making; companies need to meticulously think about competitors' actions to their activities. Monopolies exist more tips here when a solitary look what i found company regulates the market, resulting in maximum rates power however often bring in regulatory scrutiny.

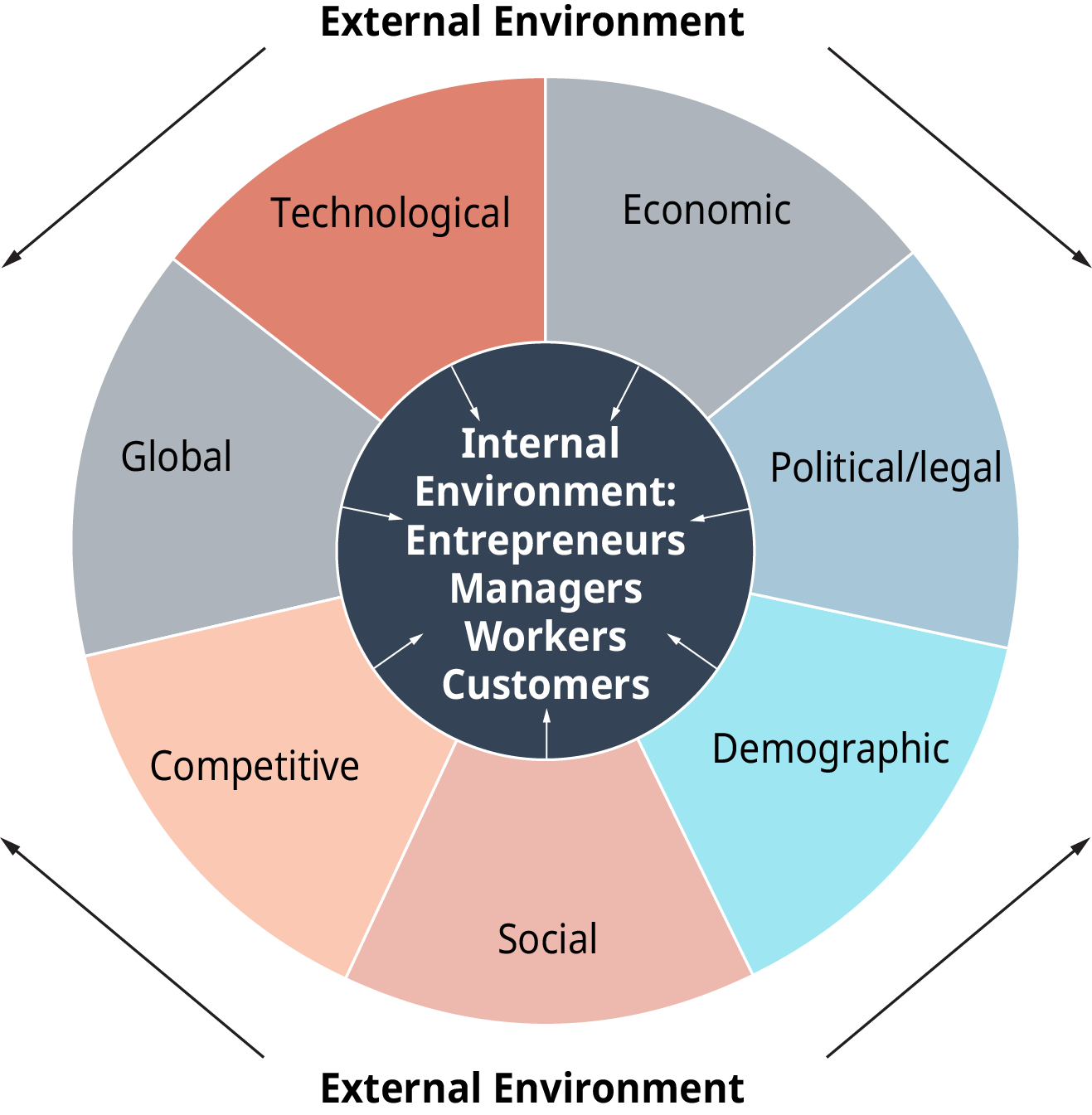

Understanding these characteristics makes it possible for services to expect market fads, adapt techniques, and enhance resource appropriation. Additionally, acknowledging how exterior elements like technology and policy impact these structures can boost critical preparation. By grasping market frameworks and characteristics, firms can make enlightened choices, eventually enhancing their competitive setting and driving sustainable growth.

Consumer Behavior Insights

Customer habits plays a pivotal duty in forming organization techniques and end results. Comprehending how consumers make buying decisions, their preferences, and the aspects affecting their habits can significantly improve a firm's capability to satisfy market needs. Key understandings into customer habits can be stemmed from assessing demographics, psychographics, and behavioral patterns.

Group aspects such as age, education and learning, income, and gender level give a foundational understanding of target markets. Psychographics dig deeper, discovering customers' way of lives, attitudes, and values, which can affect brand commitment and product assumption. Behavior understandings, such as acquiring regularity and action to promos, are important for tailoring advertising and marketing initiatives.

Furthermore, outside variables like economic problems, cultural patterns, and technical innovations likewise influence customer options. For example, throughout economic declines, consumers might focus on crucial goods over high-end products, altering need patterns.

Applying Economics to Method

Insights got from consumer habits contribute in creating efficient business approaches. By leveraging financial principles, services can better comprehend market characteristics, enhance source appropriation, and boost affordable placing. Examining demand flexibility, as an example, allows firms to readjust rates methods to maximize revenue while continuing to be eye-catching to consumers.

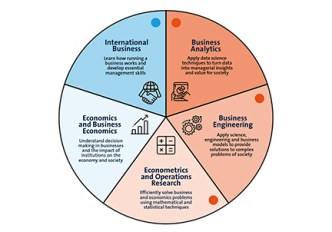

Furthermore, comprehending market segmentation allows organizations to customize their offerings, guaranteeing they meet the certain needs and choices of varied customer teams. Business and Economics. This targeted web technique improves consumer fulfillment and promotes brand name commitment

Integrating game theory right into critical planning likewise provides insights right into competitive actions, enabling firms to expect competing actions and design counter-strategies effectively.

Final Thought

In conclusion, a thorough understanding of economic principles significantly improves company decision-making. By analyzing market structures, examining customer behavior, and evaluating essential financial signs, companies can create efficient methods that align with market demands.

In the complicated landscape of modern business, an extensive understanding of economic concepts can substantially improve decision-making processes.Leading indications, such as consumer confidence indexes and stock market trends, predict future economic activity, permitting services to anticipate changes in the market. By very closely keeping track of these key financial signs, businesses can navigate unpredictabilities and place themselves properly in the ever-changing economic landscape, ultimately improving their decision-making procedures and long-lasting success.

By leveraging economic concepts, companies can better comprehend market characteristics, enhance source allotment, and boost competitive placing.In final thought, a thorough understanding of financial concepts significantly boosts business decision-making.

Report this page